In September 2020, the government announced the most significant reforms to Australia’s insolvency framework in 30 years. These reforms aim to help support small businesses work through the financial impacts of COVID-19 and plan for their future. The Olvera Advisors explain what this means for Small Businesses…

Olvera Advisors is a boutique consultancy helping businesses to reset & grow. They partner with SMEs and Small Caps to define the issues and identify practical solutions so they can take control at every phase of the business cycle – from expanding to transforming to winding down.

Words by Olvera Advisors

The impacts of COVID-19 on small businesses, especially in the fashion industry, have been overwhelming. Business owners are juggling to adjust to the immediate impacts while trying to plan their business in an uncertain future.

In September 2020, the government announced the most significant reforms to Australia’s insolvency framework in 30 years. These reforms aim to help support small businesses work through the financial impacts of COVID-19 and plan for their future.

These reforms will come into effect on 1 January 2021, if the legislation is passed.

The two main key changes in the reform are:

- A simplified Small Business Restructuring process for eligible incorporated small businesses to allow a faster and less complex process to restructure existing debts and maximise chances of survival.

- A simplified Small Business Liquidation process for eligible incorporated small businesses for a faster and more cost-efficient liquidation process.

This process allows a small business to continue trading under the control of its owners while a debt restructuring plan is developed and voted on by creditors. This is different from the current model where creditors can appoint external administrators and the restructuring practitioner has control of the business during the process.

To be eligible, the company must:

- have less than $1m in liabilities; and

- pay all employee entitlements which are due and payable before a restructuring plan to creditors can be made.

There may be other criteria once the legislation is finalised.

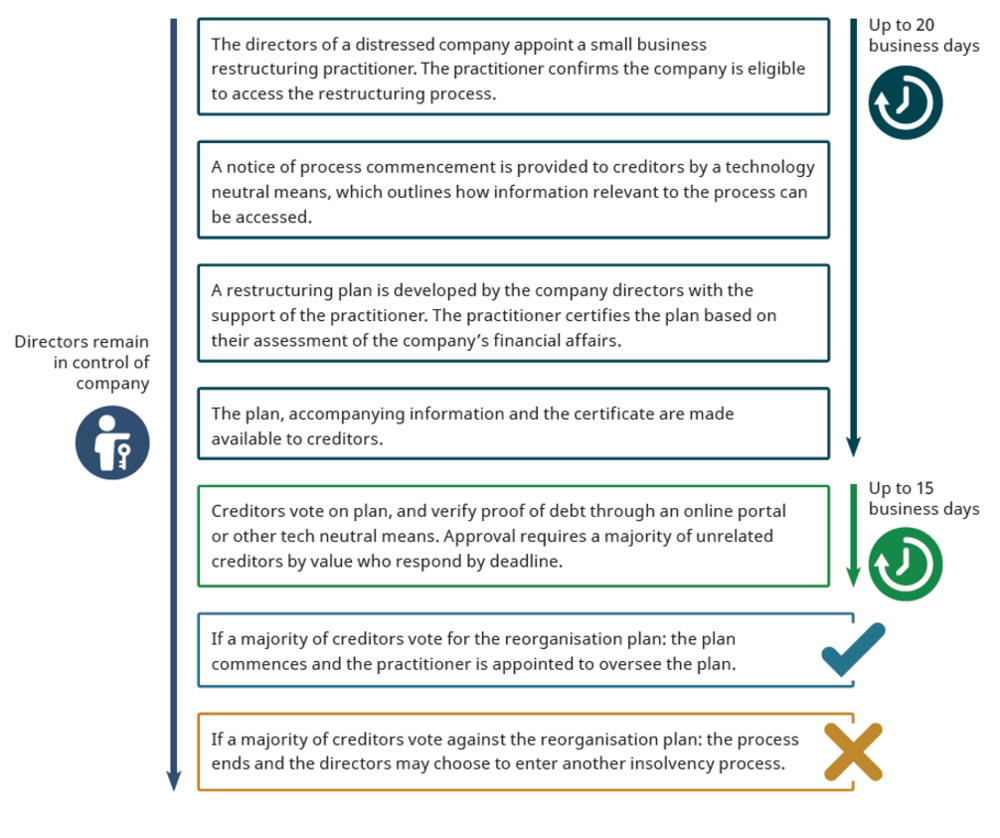

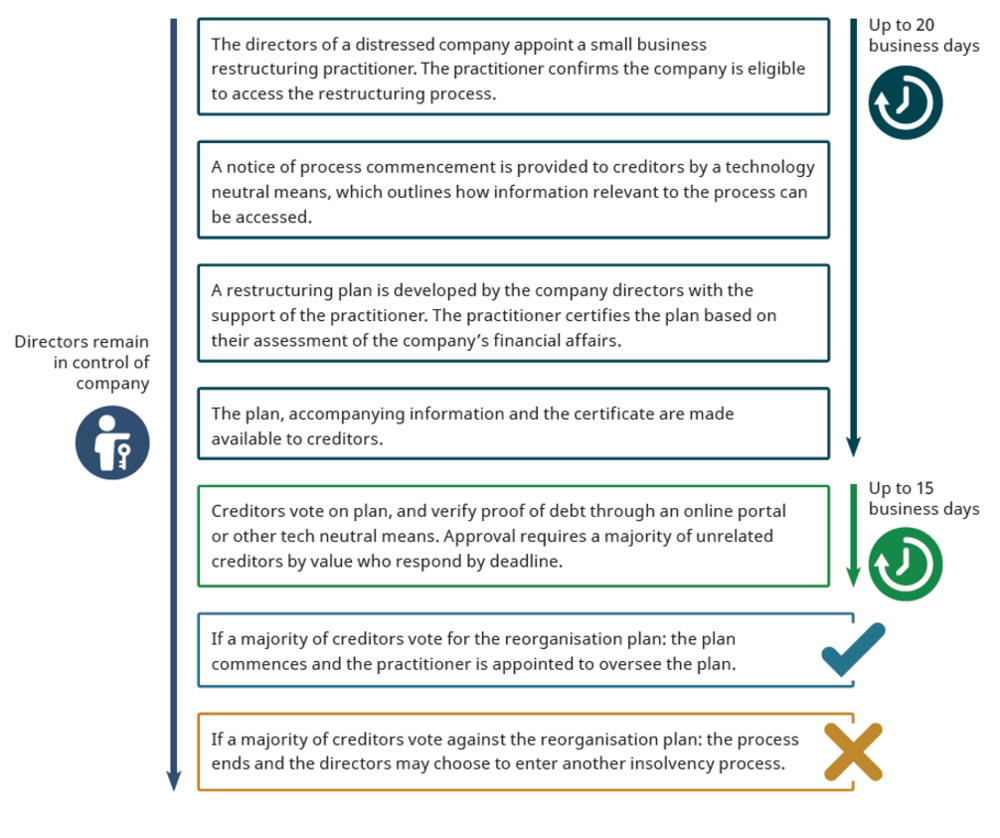

The process starts with the appointment of a restructuring practitioner and developing a restructuring plan. Unsecured creditors and some secured creditors will not be able to take any action against the company once the process commences.

The restructuring plan will have to be developed and submitted to creditors within 20 business days from when the practitioner is appointed. Creditors will then have 15 business days to vote and approve the restructuring plan once submitted.

The restructuring plan will be approved if at least 50% of creditors in value vote for it. Related-party creditors will not be able to vote on the restructuring plan.

If the majority of creditors vote against the restructuring plan, the process ends, and directors may choose another insolvency process.

The diagram below details the small business restructuring process:

(Table Source: Australian Government, Insolvency Reforms fact sheet)

As the legislation is still being finalised, and some may not be able to immediately access the process come 1 January 2021, an eligible business will be able to declare its intention to use the simplified restructuring process to its creditors until 31 March 2021. Once the declaration is made, directors will have temporary relief from insolvent trading liability and statutory demands for a maximum of 3 months or until they engage a restructuring practitioner, whichever comes first.

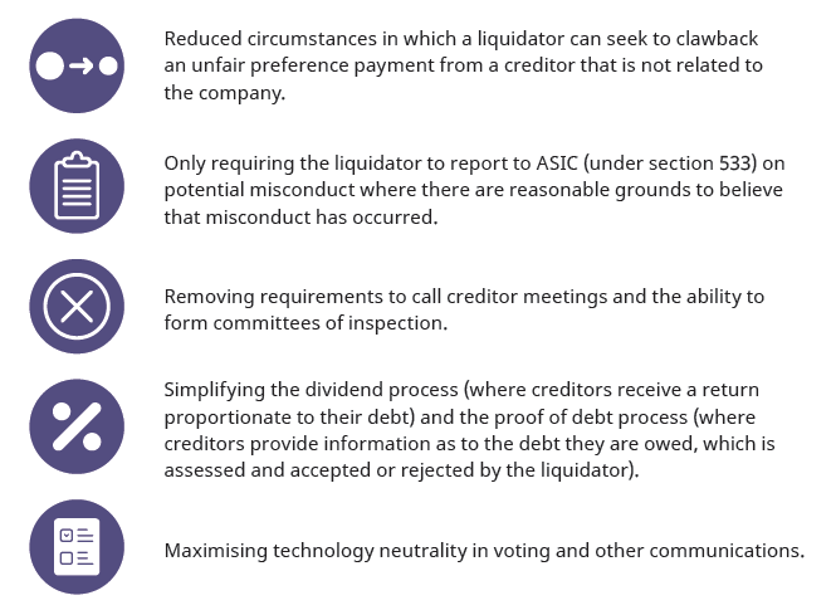

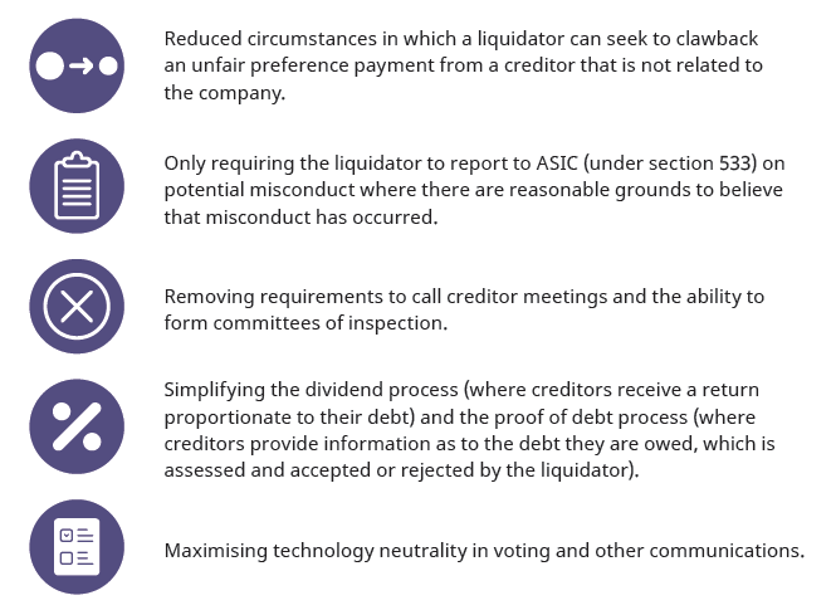

The reform provides time and cost savings in a liquidation by having less investigative, meeting and reporting requirements when compared to the traditional liquidation process as set out in the diagram below:

(Diagram Source: Australian Government, Insolvency Reforms fact sheet)

To be eligible for a simplified liquidation process:

- the company must have less than $1m in liabilities; and

- the directors must declare that they believe that the company is eligible and has not engaged in illegal phoenix activity.

There may be other criteria once the legislation is finalised.

Creditors will be able to convert the Small Business Liquidation of a company to a ‘full’ liquidation process and will prevent directors from using the simplified process more than once within a prescribed period (currently 7 years).

The small business insolvency reforms allow a faster and less complex process to restructure existing debts and maximise a business’ chance of survival in a post COVID-19 landscape.

You can connect with Olvera Advisors via

© 2024 AUSTRALIAN FASHION COUNCIL All Rights Reserved